In the fast-moving world of banking and finance, it is not just a case of being first but also a race to be in step. A well-trained workforce in this context is therefore not just a material asset but a strategic advantage, as increasingly expanding regulatory needs go hand in hand with the rapid use of technology. For instance, according to a recent report by the Financial Times, financial institutions with enterprise-wide training programs reported 30 percent fewer compliance breaches than those with less comprehensive training programs. This very fact underlines that training minimizes risks and, at the same time, assures business success.

Challenges in the Banking and Finance Sector

The banking and finance industry presents a very complex environment under tight pressures from several large-scale challenges, among which are the following:

- Regulatory Compliance: Constantly changing regulations regarding Know Your Customer, Anti-Money Laundering, General Data Protection Regulation, and Basel III make it very necessary to keep updating one's knowledge with relevant training so that one may avoid costly penalties and remain compliant.

- Technological Advancements: Rapid evolution characterizes the Fintech world, cybersecurity, and blockchain; thus, your employees must be continuously trained to keep pace with every new tool and methodology.

- Risk Management: Enhanced risk management includes credit risk, operational risk, and compliance risk assessment, measurement, and mitigation. Such training must be deep and responsive concerning events affecting the appearance of new standards related to the management of these risks.

- Cost Efficiency: The personnel can be very heterogeneous and even dispersed geographically, and this presents several problems when trying to organize training for such diversity; therefore, there is an urgent need for cost-effective solutions.

- Customer Service Excellence: Superb customer service requires that one undergo training in relationship management, effective communication, and the use of data-driven insights in improving relationships with clients.

How eLearning Can Help

eLearning offers significant benefits that address these challenges:

- Flexibility and accessibility: The facility of eLearning is that employees can choose the time of access and from wherever they want. In case there are people in different time zones or have lesser availability, this would help.

- Scalability: Since it is online, scaling up the training programs becomes easier whenever requirements arise, and changing business needs are met with consistent quality throughout the organization.

- Consistency: Offers the same level of training in all locations as the employees would have had the same knowledge and abilities.

- Cost-effective: The cost of travel, hire of venue facilities, and printing of materials is saved with online training.

- Engagement: The different interactive modes might include simulation-based, game-based, and virtual reality-based interactions that increase the interest and retention of the learners.

- Data-Driven Insights: With its tracking and analytics features, this tool offers insights into learner performance to find knowledge gaps for optimization of the training content.

Key eLearning Areas for Banking & Finance

eLearning effectively addresses key areas in the banking and finance sector by offering in-depth solutions for each of these areas. This could be on regulatory compliance; newer training programs are proposed on regulatory standards such as Know Your Customer, and Basel III, using interactive scenarios and assessments that employees can apply in real-world situations to demonstrate compliance knowledge.

- Technology Proficiency: Training in FinTech innovations, cybersecurity protocols, and blockchain applications includes the use of simulations and practical exercises to enhance proficiency with the latest technologies and banking software.

- Risk Management: Courses are aimed at risk assessment and mitigation approaches by practicing, through case studies and simulations, credit risk analysis, stress testing, and adherence to evolving risk management standards.

- Customer Service Excellence: Focuses on relationship management and engaging the client through role-plays and data-driven case studies to enable staff to respond to the various client needs.

- Financial Product Knowledge: Undergoes extensive training in financial products, ranging from investment portfolios and loan structures to insurance products. Workers learn how to explain, even to the simplest layperson, some of the most complex financial products with interactive modules and real-life scenarios.

- Leadership and Management: Builds leadership skills through strategic thinking, decision-making, and team management. The method of leadership simulation and scenario-based learning is very helpful in creating the leading capability within a dynamic environment.

- Digital Transformation: The training needed for transitioning to digital banking involves learning about digital platforms, UX/UI optimization, and big data analytics. Training includes hands-on exercises with practical and real-life examples to prepare employees for leveraging digital tools in making informed decisions.

- Partner Training: Provides training modules on the alignment of partners and stakeholders about ethical standards and regulatory requirements through compliance workshops.

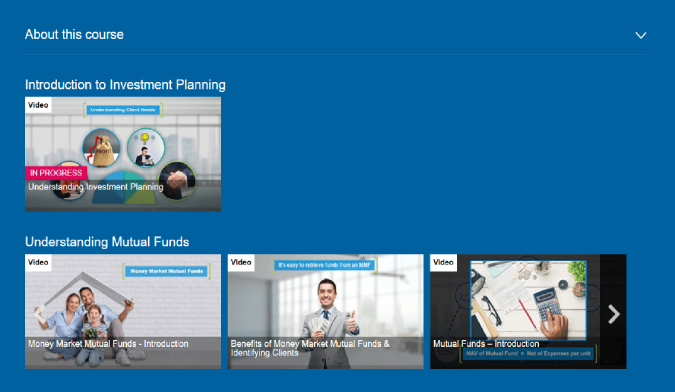

A well-conceived training program can mean the critical difference between success and failure in today’s very competitive financial services. An outdated Flash-based sales training was causing a leading life insurance company a great deal of pain; it was less accessible and less engaging for their learners. The company needed to modernize the training experience-mobile-friendly and more effectively resolve these issues.

Upside Learning collaborated with them to revamp this into a challenging opportunity. We introduced Nuggetization in order to make them compliant on mobiles and created several very engaging live-action videos enhanced with superimposed animation. The idea behind this approach was to present the training as more engaging and accessible on multiple devices.

This indeed brought about a pretty good effect. The training redesign was now being delivered through a mobile-friendly DAP format, thus making the accessibility and engagement of the learners greater. The inclusion of live-action videos with enhanced graphics made for better effectiveness and memorability of the training with the employees themselves.

The main pointers of the revised program were developing learning nuggets and interactive videos compatible with mobile access, increasing access and engagement manifold. The value addition in terms of content ensured that the learners enjoyed their training both at an information-gaining and motivational level, setting a benchmark for effective sales training in the industry.

Our Unique Value Proposition

What makes us different is the scientific approach to eLearning at Upside Learning. Extensive industry research coupled with state-of-the-art instructional design methodologies goes into creating effective and engaging training solutions. Our customized eLearning ensures that banking and finance professionals are better prepared to deal with everyday challenges thrown up by a fast-moving industry.

At Upside Learning, it is all about investing in training solutions that would bring real results and continuing development for the workforce. Please feel free to contact us at elearning@upsidelearning.com to discuss how our solutions can benefit your organization or would like more information about how we have helped other banks.