Enter eLearning, a powerful solution that is causing a paradigm change in training from the banking to the financial industry. eLearning has become the fastest and most effective way of training employees in a very dynamic field. Look into how eLearning is changing financial services training and how it quickly has become a required tool for success.

The Need for Financial Literacy and Skills Development

While traditional classroom training can sometimes be cumbersome and costly, e-learning provides a cost-effective process that can involve any number of both large and small groups.

Continuous Learning in the Face of Regulatory Changes

In response, many banks and financial institutions have begun to pivot to eLearning to help guarantee compliance among their staff. Courses may be swiftly updated to reflect the most recent regulatory needs, and staff can obtain specialized training on specific topics like anti-money laundering (AML) or Know Your Customer (KYC) rules. This real-time updating feature enables training content to be synchronized with the most recent industry norms, avoiding costly mistakes and assuring corporate compliance.

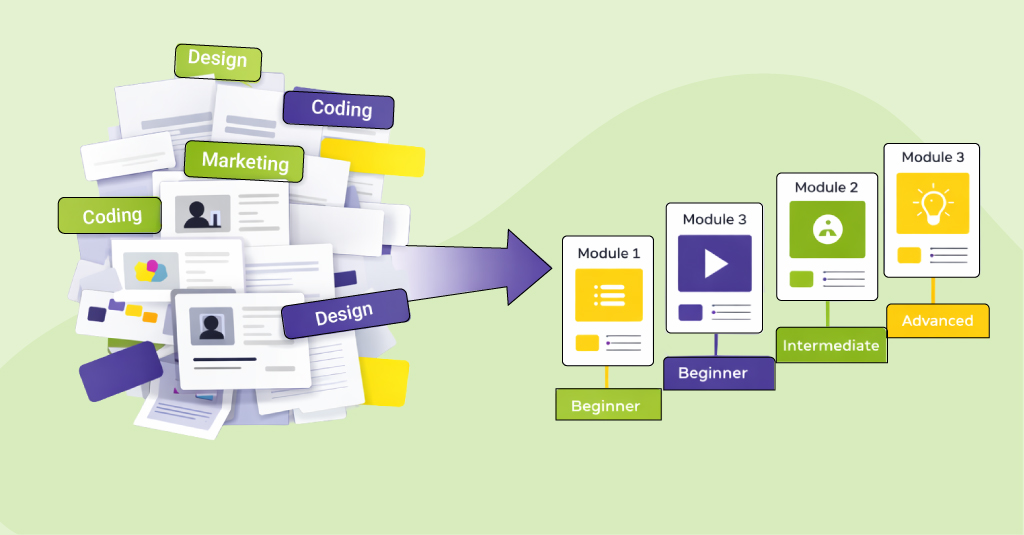

Personalized Learning for Diverse Roles

The banking and finance sector hires people across a range of lines, including customer service representatives, risk managers, and compliance officers, each of whom has different training needs. Standardized training programs do not fit within this context anymore. With eLearning, banks can customize their role-focused training so that their employees learn exactly the skills and knowledge relevant to each of their positions.

Be it specialized financial modeling, credit analysis, or better customer communication, eLearning can tailor specialized courses based on a learner’s role, experience, and level of competence. This personalization helps to bridge the gap in skills because individual needs are catered to. In this way, this helps increase learner engagement and retention of knowledge.

Leverage Data for Continuous Improvement

One of the sea changes in e-learning is the automatic tracking of learner progress. Organizations are integrative, scientific, and data-driven. Organizations can thus use data analytics to monitor employee engagement, identify skill gaps, and customize future training for greater effectiveness. This data-driven targeting of learning intervention makes for a far more efficient and effective training process.

For example, if employees have difficulty constantly tackling some complex financial rules, the bank can enhance its curriculum by providing a deeper rooting in that subject. The use of data to customize training upkeep the institution trains its staff while always growing.

A Future-Proof Solution

Furthermore, eLearning portals allow financial institutions to integrate novel technology into their training processes. For instance, eLearning courses are now introducing virtual reality and augmented reality experiences that simulate real-life scenarios. These technologies, therefore, facilitate employees to be involved in highly complex financial simulation exercises that run the gamut from risk management to customer interaction.

Areas Where eLearning Can Help in Banking & Finance Training

-

Compliance Training: To guarantee that staff members are constantly compliant with the most recent standards, eLearning may provide current training on changing rules like KYC, AML, GDPR, and more.

-

Risk Management: Employees can better manage financial risks by learning and using risk management strategies through interactive simulations and case studies.

-

Financial Product Knowledge: Employees can boost client interactions and decision-making by using eLearning to gain a better understanding of the financial products they sell.

-

Customer Service Excellence: Employees can acquire the best practices in customer service, from handling challenging circumstances to offering customized financial advice, through role-based training.

-

Digital Banking Skills: With the growth of digital banking, staff members may receive cybersecurity, mobile apps, and online platform training to ensure they can satisfy the demands of today's tech-savvy clients.

-

Leadership & Management Development: With instruction in subjects like strategic thinking, team management, and decision-making, customized eLearning programs can focus on cultivating future leaders.

-

Onboarding New Employees: It is easy to onboard employees using structured eLearning sessions. Employees learn at their own pace about the various financial products, industry rules, and business policies.

eLearning Solutions by Upside Learning for Banking & Finance

Our services aim to bridge the skills gap, keep workers abreast of changes in regulations, and facilitate individualized learning paths for a range of positions. We work together with our customers to create personalized eLearning courses covering topics like risk management, customer service, digital literacy, compliance, and financial laws.

We make sure that learners connect with the material in a way that is effective and efficient by utilizing the newest learning technologies, like gamification, interactive simulations, and mobile learning. Upside Learning’s solutions are made to promote long-term success in the banking and finance sector, whether that means developing immersive learning environments or training that is simple to adapt to new requirements.

In an industry where staying ahead is the demand, and being agile is all about flexibility, Upside Learning is the very infrastructure that assists a business that satisfies today’s demand and prepares itself for tomorrow’s future.